Advisor portal quick start guide

About Agora

Who we are

Agora is a Level 4 carrying dealer, providing intermediary accounts, custodial services, innovative investment options, back-office services, and technology solutions to independent dealers and their advisors.

Take control

We believe that reducing the time spent by advisors on low value work improves the ability to focus on business development, financial planning and elevating an advisor’s value proposition across all client segments. Agora’s Advisor portal provides access to a transformative digital client onboarding experience, elegant and intuitive asset servicing functionality, and a range of customizable high-quality Managed Solutions, tailored to each client’s risk tolerance and goals.

How we work with dealers

The dealer maintains responsibility for compliance processes, oversight on reviews and approvals, providing support and the bulk of advisor training, managing advisor compensation, and ensuring the smooth operation of dealer activities. We work closely with dealers to integrate their requirements into our technology platform. Each dealer is unique and has the option of integrating specific KYC and an Investor Profile questionnaire into the portal their advisors use.

Agora is responsible for executing transfers-in and trades requested through the Agora advisor portal. Additionally, we provide training and client services support to advisors using the portal, along with the preparation and distribution of client statements, trade confirmations, and tax receipts.

Accessing the advisor portal

To access the portal, an advisor needs to request that their dealer provide Agora with their rep code and company email address so that Agora can establish the advisor’s portal account. Once that is done, the advisor receives an invitation by email, including a link to the portal specific to the advisor’s dealer, where the advisor sets up their secure password.

Advisor support

For assistance with the process of setting up initial client accounts, advisors can reach out to our customer excellence team at info@Agoracorp.ca or by calling 1-855-462-4672. In the first or second meeting with any advisor new to the platform, Agora assigns a member of the customer excellence team to the advisor. Their role is to guide the process, promptly address any inquiries, and offer ongoing support.

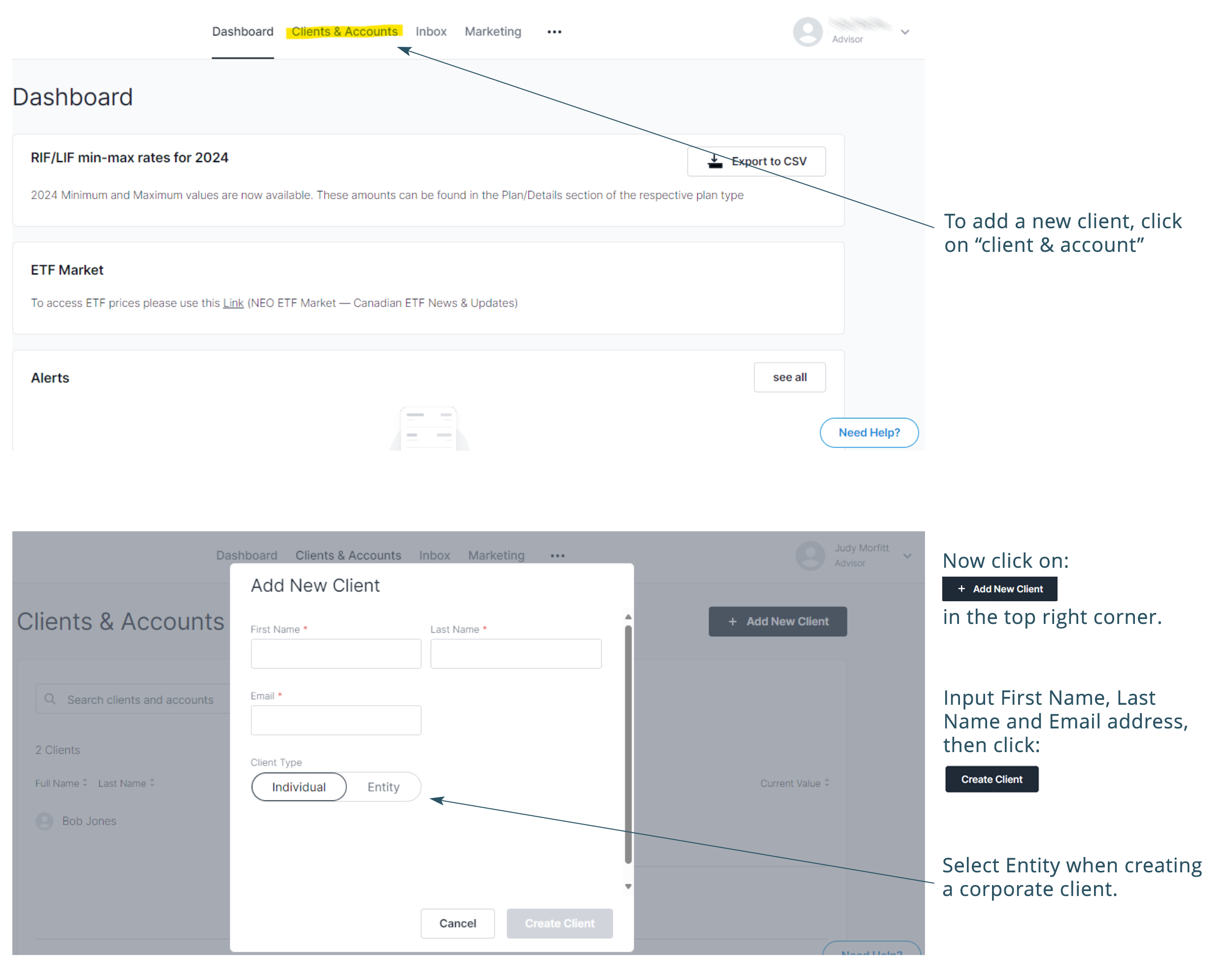

Add a new client

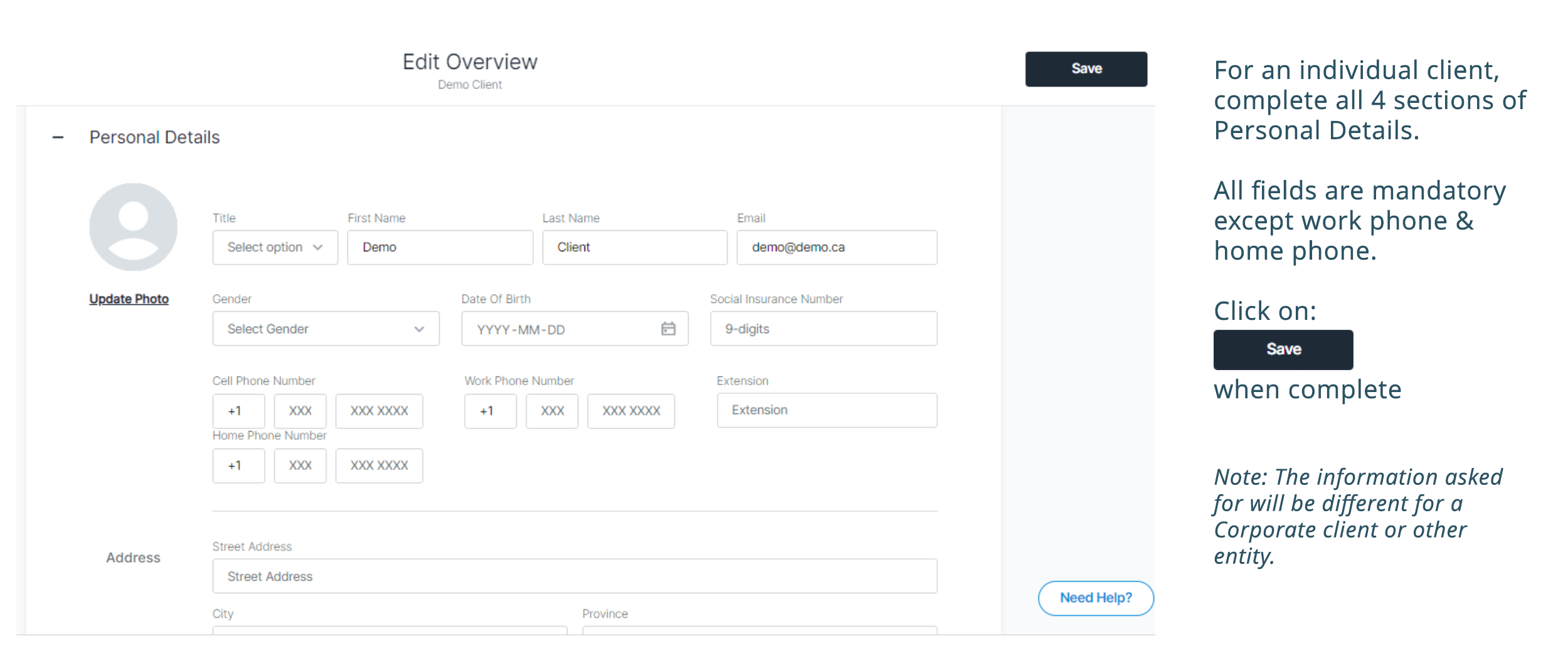

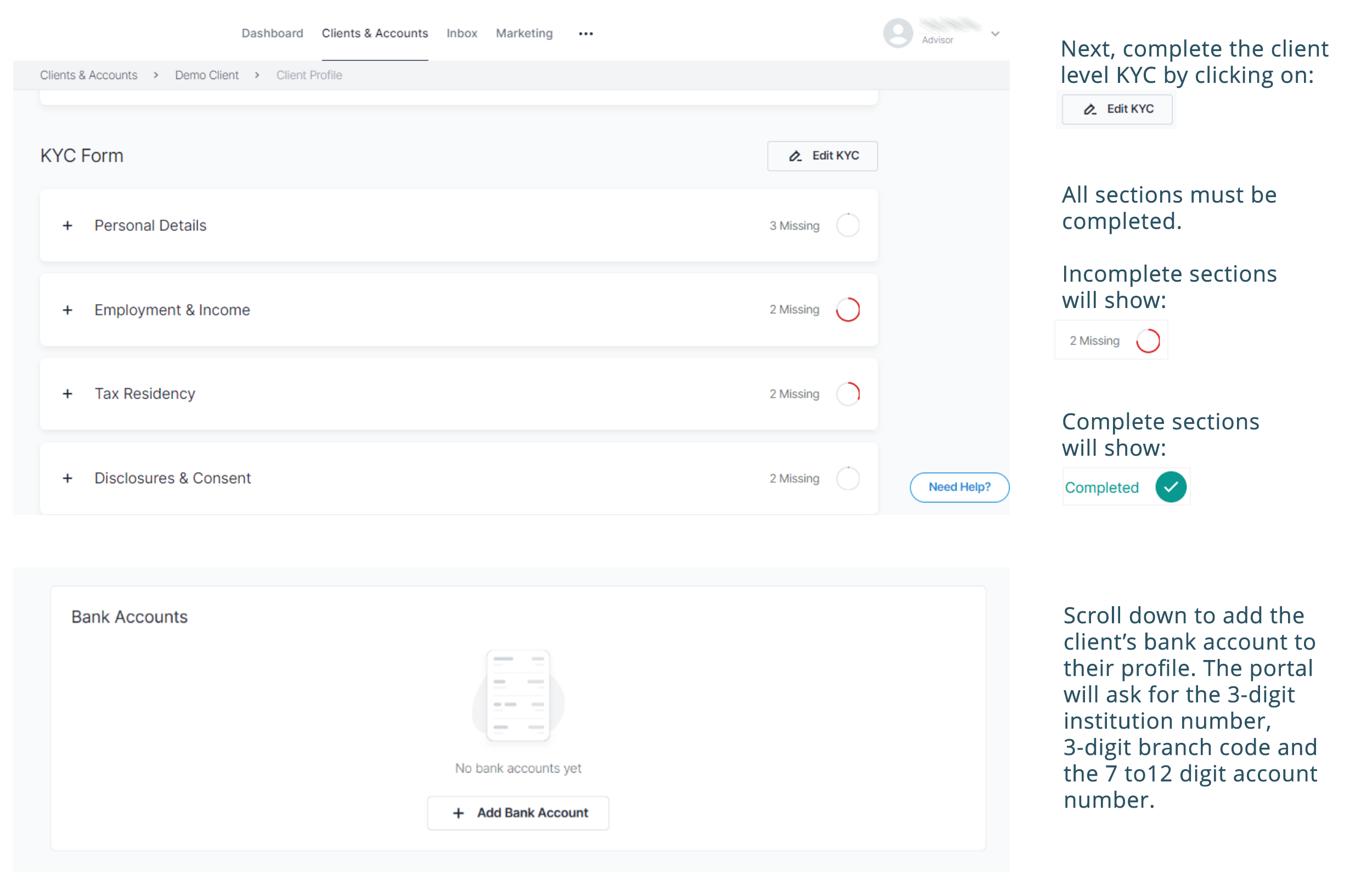

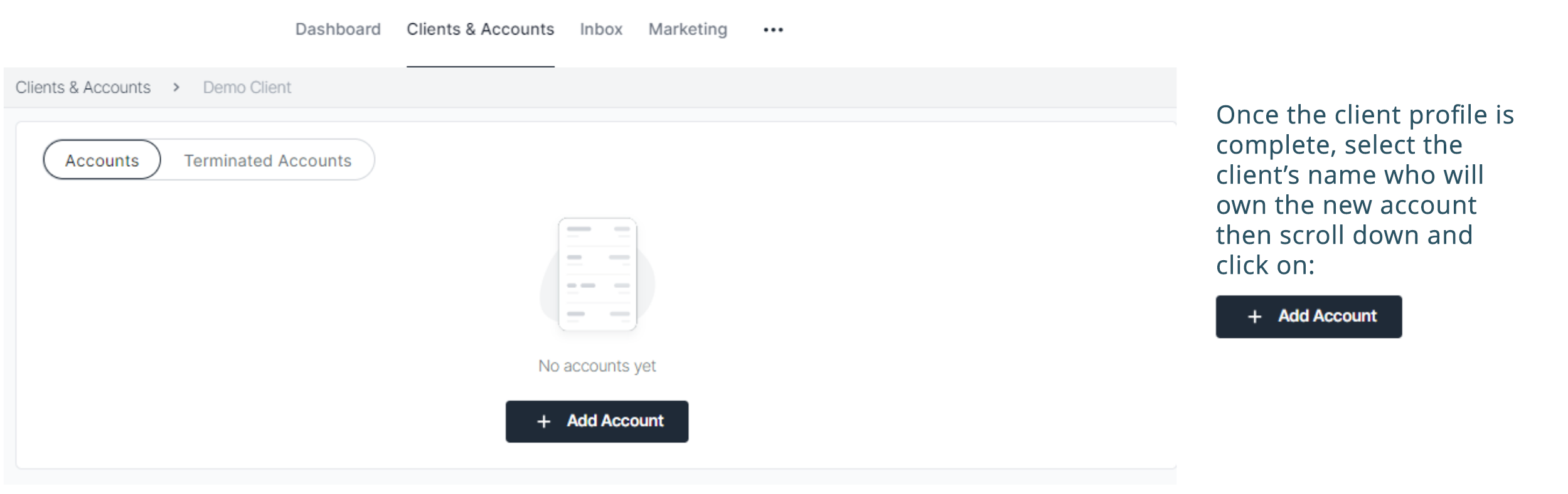

To get started, advisors first need to add the client and complete their profile. Once the client profile is set up, the advisor can then proceed to open accounts and initiate transfer requests, allowing the portal to generate all the required documents for signature.

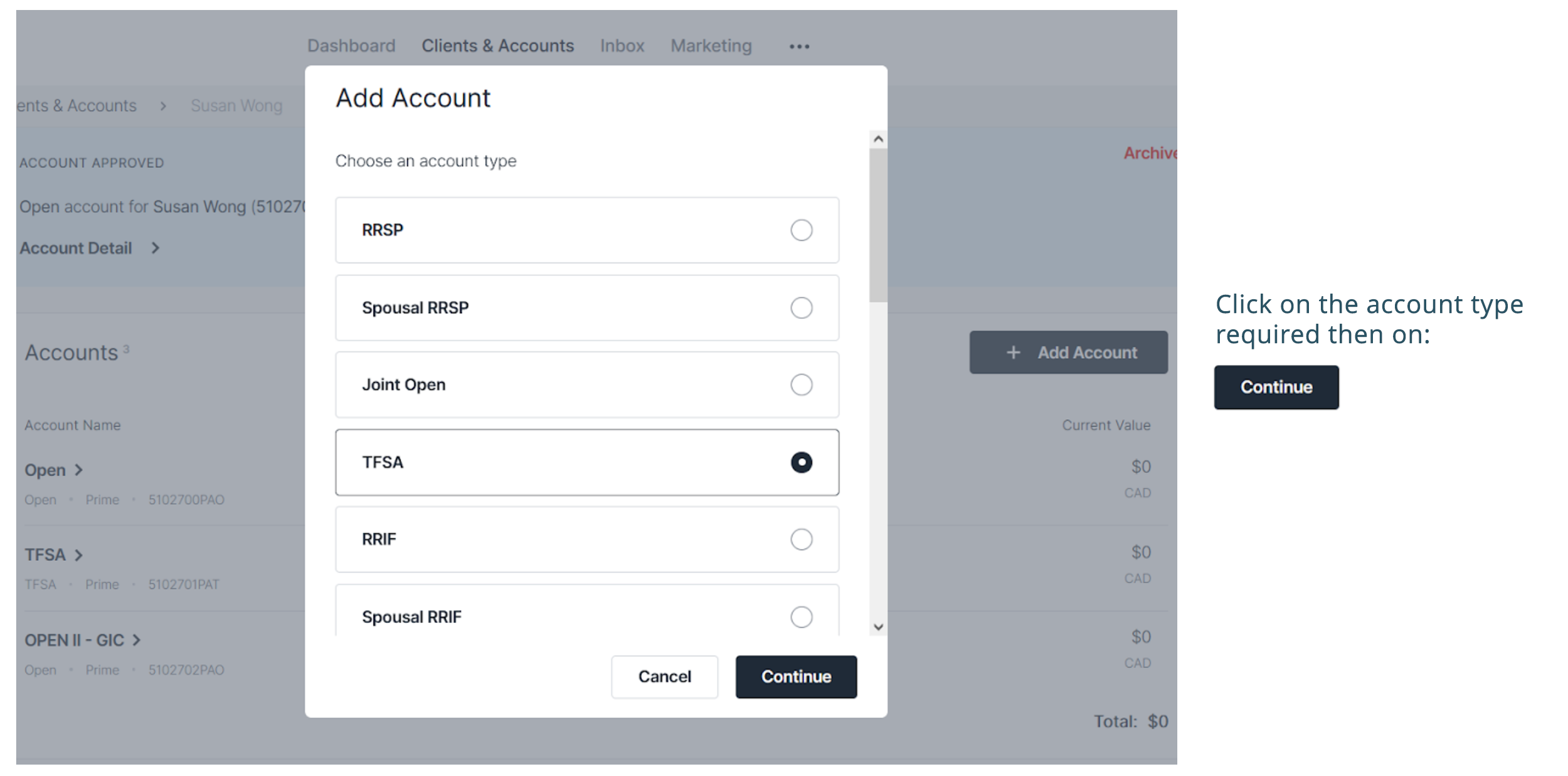

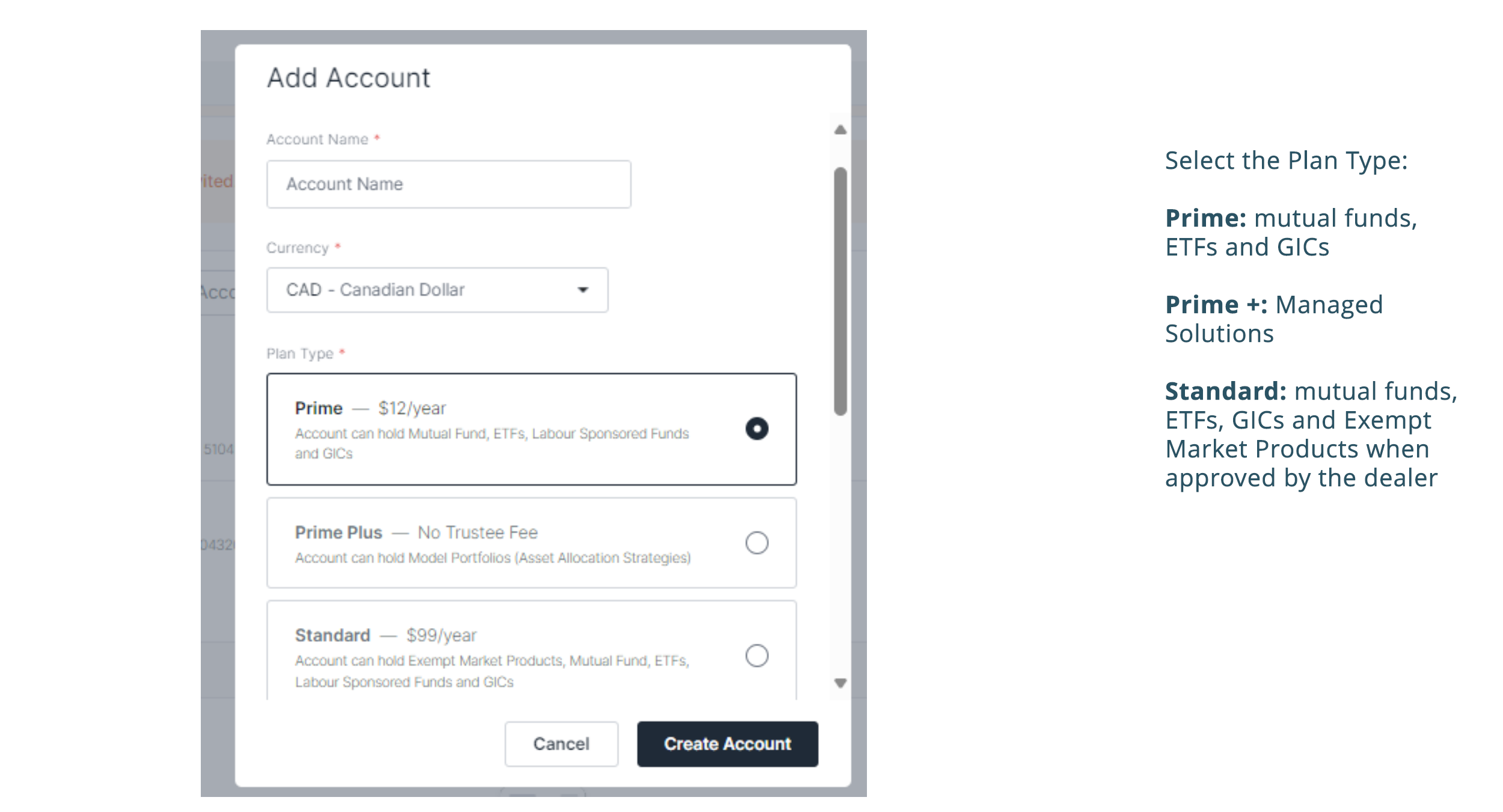

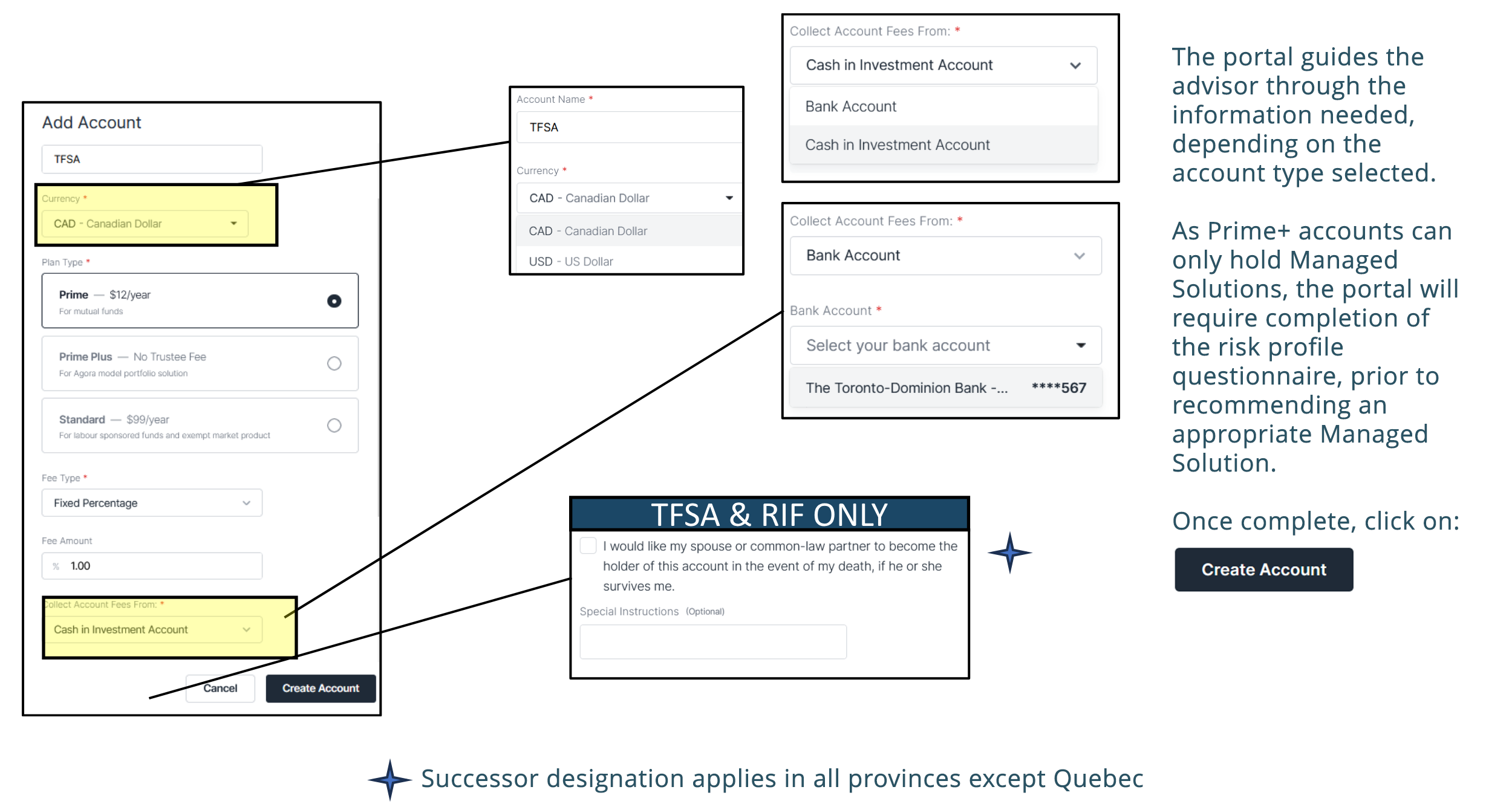

Open new investment account

Some dealers also require the advisor to complete account level KYC plus an investor questionnaire for all accounts. The Agora portal is configured to satisfy each dealer’s compliance guidelines. All required documents are populated using the information entered into the portal, then assembled into a package for the advisor’s review and client signatures.

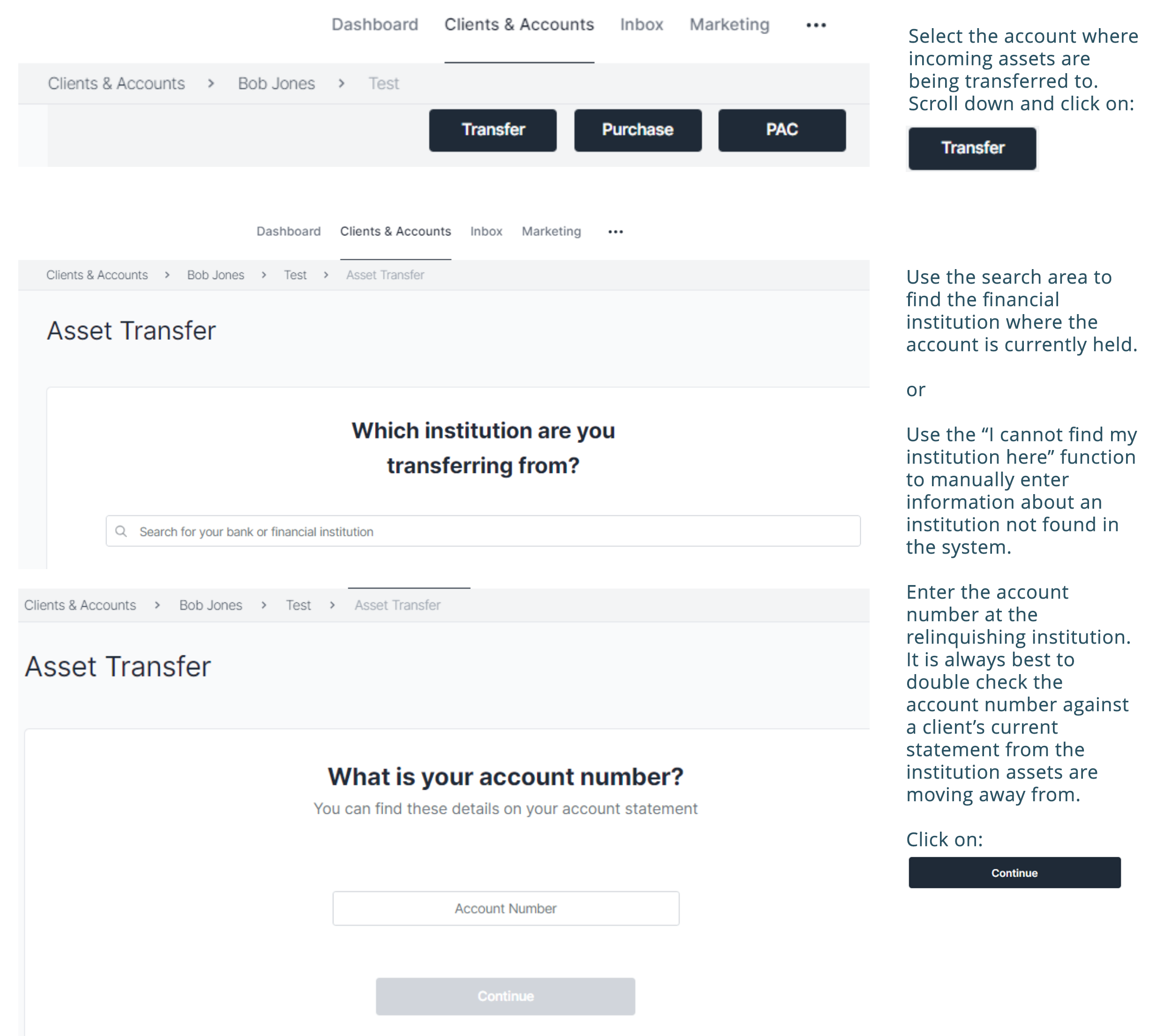

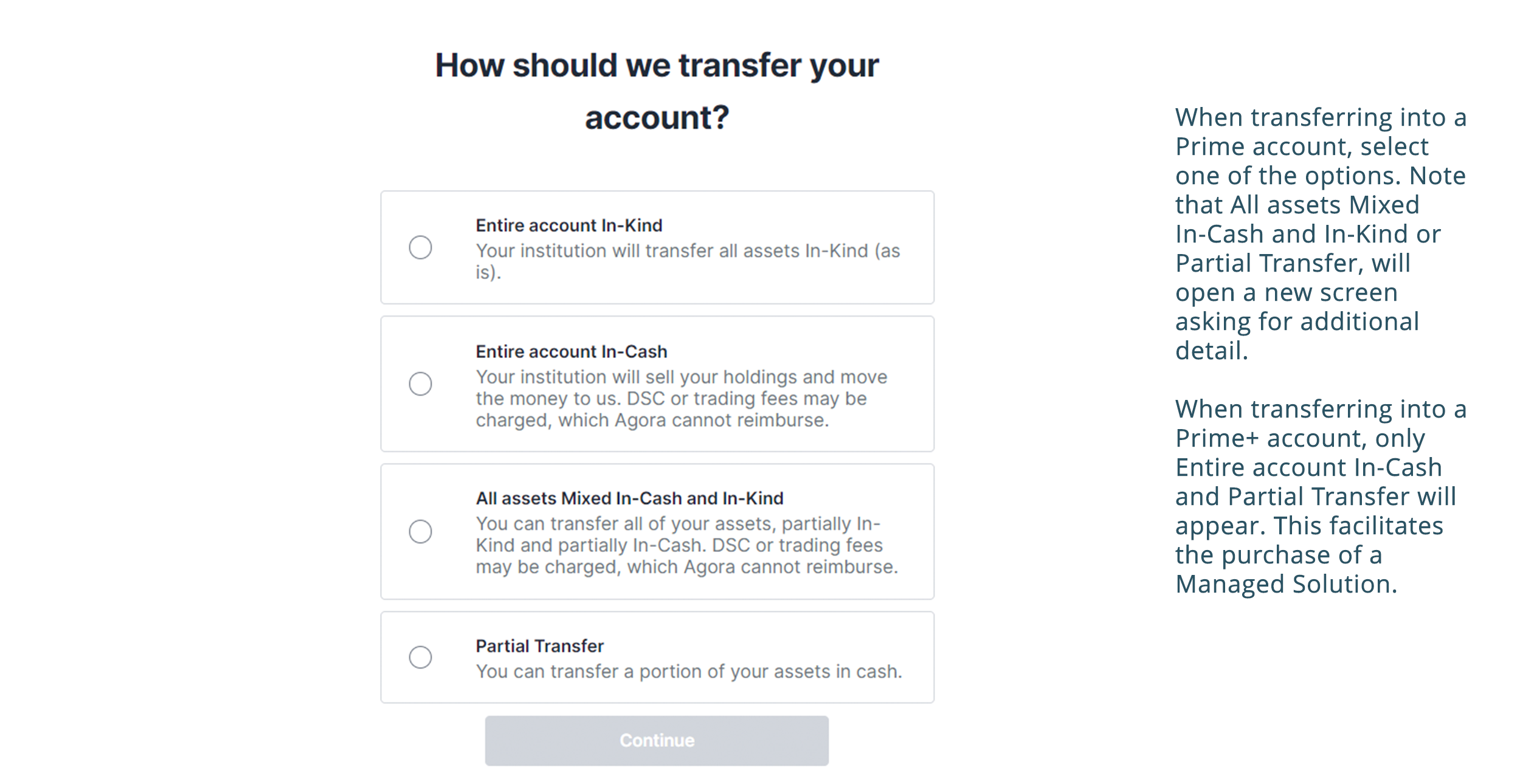

Initiate transfers from financial institutions

When a partial transfer is selected, the portal will ask additional questions that feed into the transfer authorization form for the client’s signature.

Important tax information

The potential tax implications of a cash transfer need to be taken into consideration. While capital gains will not be triggered on registered accounts (RSP, RESP, etc.), an open/non-registered account may be in a gain position and in that situation, is best transferred in-kind.

Products that can not be transferred in-kind

GICs held at Home Trust can be transferred in-kind. All other GICs must be redeemed at the end of the term and then transferred in cash.

ETFs must be redeemed and transferred in cash.

When considering the transfer of proprietary products, read through the prospectus of that product first to confirm if they can be held at another dealer.

Transfer Timelines

Once client signatures are received on all required documents, Agora will initiate the transfer request within two business days. Receipt of the transferred funds are completely dependant on processing at the relinquishing institution. Assets coming in will take a minimum of three weeks. Depending on where the transfer is coming from, the timeline may be longer

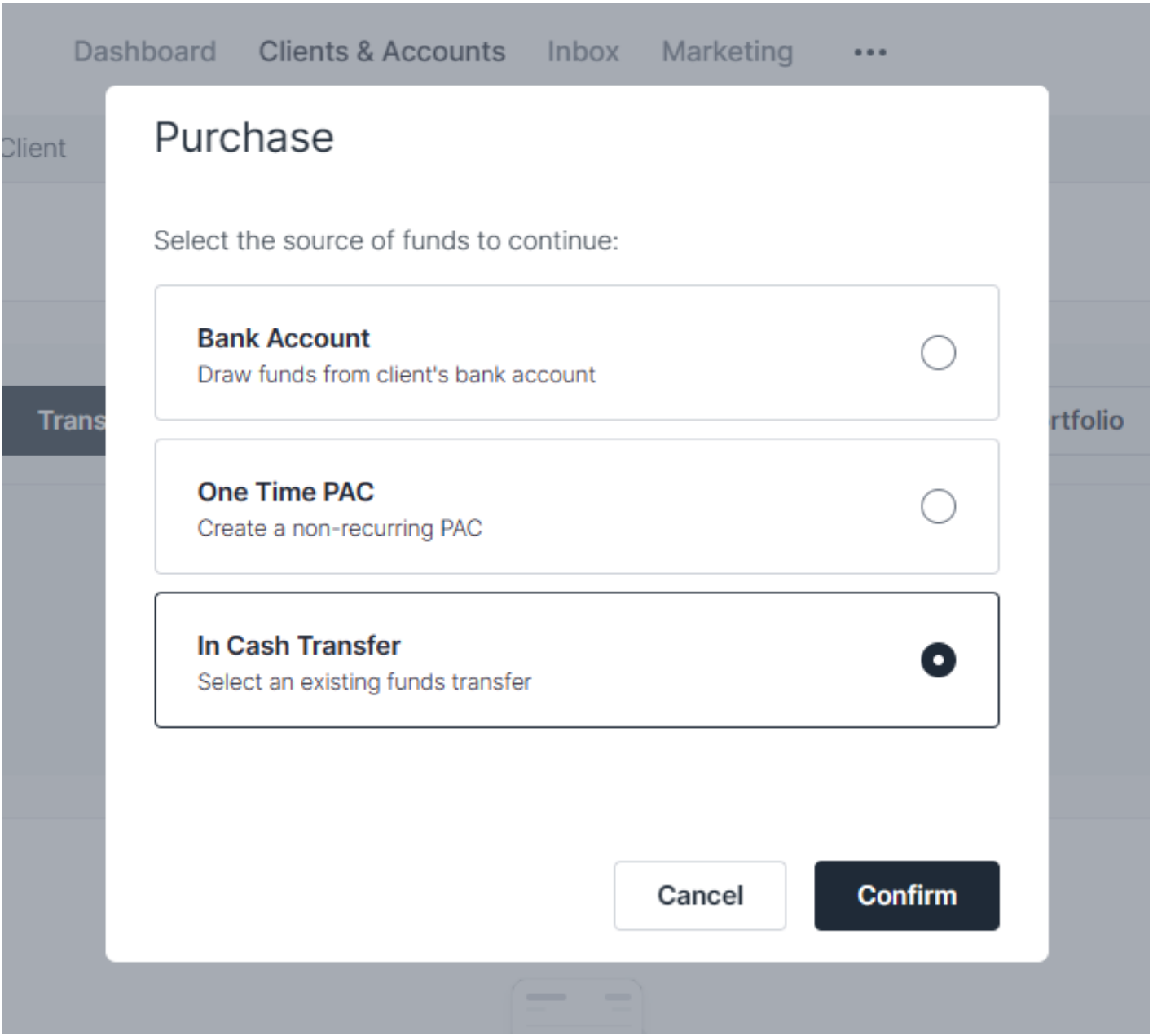

Purchase a Prime+ Managed Solution

When transferring cash into Prime+, a purchase of the Managed Solution must also be initiated. This is done by selecting the Prime+ account the transferred cash will be deposited into, clicking on purchase and indicating In Cash Transfer to select an existing funds transfer.

To purchase a Prime+ Managed Solution from a Prime account, initiate a transfer-in from Agora Dealer Services Corp. using the Prime account number.

Funds for the purchase can also be taken directly from the client’s Bank Account.

Secure electronic signatures from clients

Agora’s advisor portal automatically generates a document package with all required forms for the advisor’s review and client signatures, based on the type of account opened and/or transaction requested. Once the advisor has completed opening the account and adding any transfers or transactions, they simply click on:

The advisor will receive an email, containing a link to review, initial and e-sign where required on documents in the package. Once the advisor has signed, they then send the package to the client for electronic signatures through the portal. The client receives an alert inviting them into the client portal to review and sign. Processing begins once client signatures are received. At some dealers, the signed package is first sent to the dealer’s compliance team for review and approval.

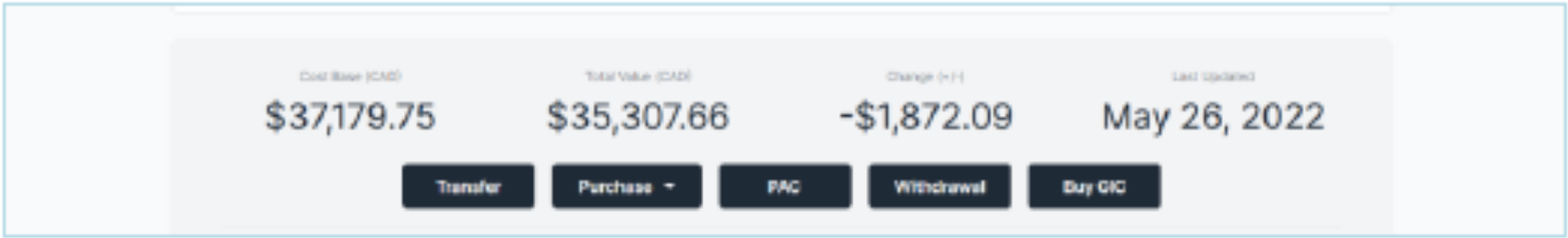

Processing transactions moving forward

To initiate any transaction, the advisor first selects the account, then scrolls down to a series of buttons that look something like this:

TRANSFER: Select Transfer to initiate a new transfer-in

PURCHASE: Select Purchase to set up a one-time investment purchase

PAC: Select PAC to set up a one-time or ongoing pre-authorized contribution

WITHDRAWAL: Select Withdrawal to set up a one-time withdrawal from the Agora investment account

SWP: Select SWP to set up an ongoing withdrawal from the Agora investment account. Note: Ongoing systematic withdrawals are only available for OPEN and TFSA plans.

Once the type of transaction has been selected, the portal guides the advisor through the information needed to create the appropriate forms for signature and processing.